Simple And Easy Currency Conversions: Checking out Toronto's Exchange Options

Simple And Easy Currency Conversions: Checking out Toronto's Exchange Options

Blog Article

Discover the Secrets to Making Smart Choices in Currency Exchange Trading

In the fast-paced globe of currency exchange trading, the ability to make enlightened decisions can be the distinction in between success and failure. As investors navigate the intricacies of the market, they often look for elusive keys that can provide an edge. Recognizing market patterns, executing effective threat monitoring methods, and examining the interaction between essential and technological factors are simply a couple of aspects that add to making smart choices in this arena. There are deeper layers to check out, consisting of the psychology behind trading decisions and the usage of sophisticated trading tools. By peeling off back the layers of this elaborate landscape, investors might uncover hidden understandings that could possibly change their method to money exchange trading.

Comprehending Market Fads

A comprehensive understanding of market trends is vital for effective money exchange trading. Market trends refer to the basic instructions in which the market is conforming time. By comprehending these patterns, investors can make even more enlightened choices concerning when to buy or sell currencies, ultimately optimizing their profits and minimizing possible losses.

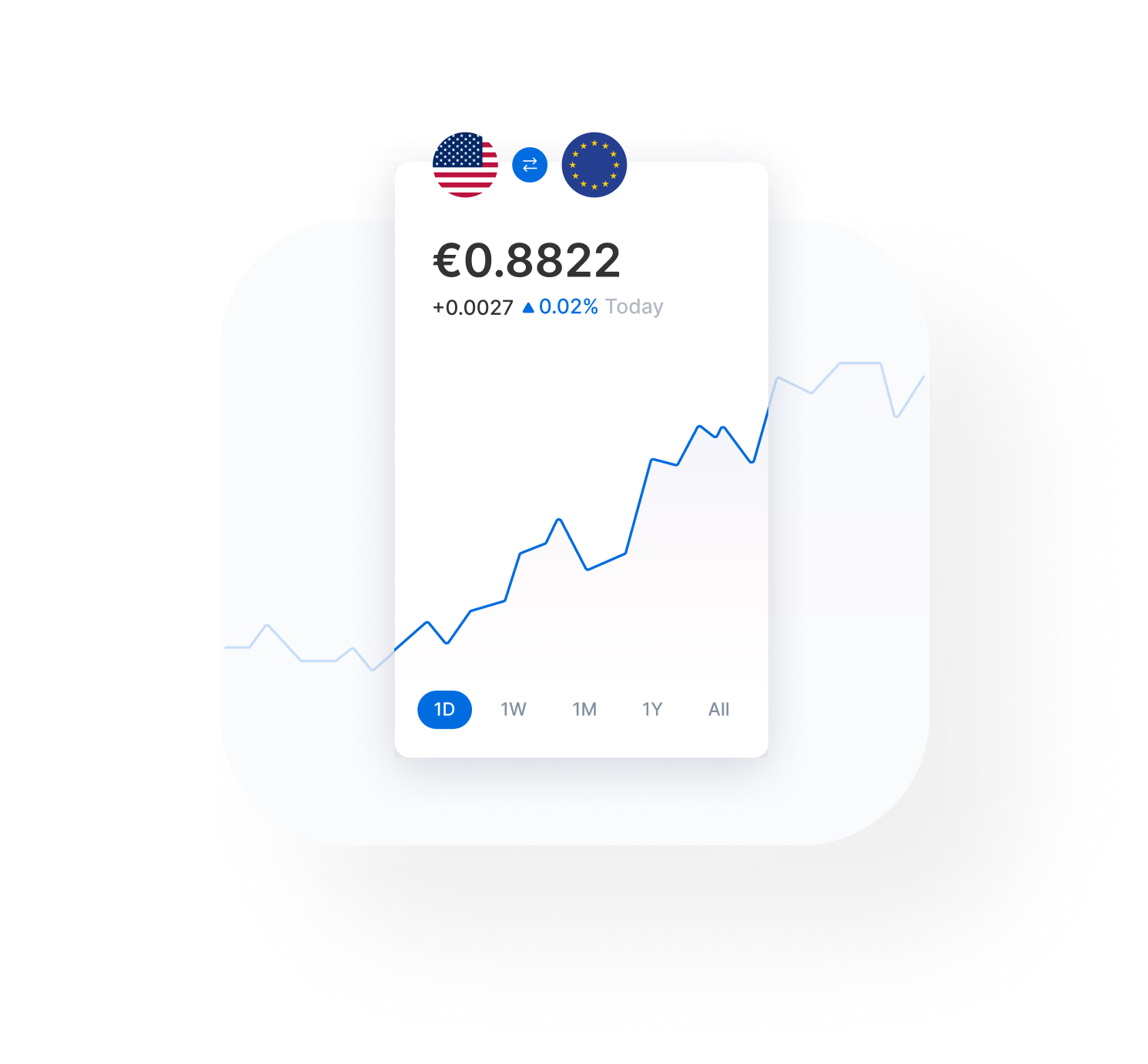

To properly assess market patterns, investors usually make use of technological evaluation, which includes examining historical rate graphes and utilizing various indicators to anticipate future cost movements. currency exchange in toronto. Essential analysis is likewise necessary, as it entails evaluating economic indications, political events, and various other variables that can influence money worths

Risk Monitoring Methods

Just how can money exchange traders efficiently mitigate possible dangers while optimizing their investment opportunities? One vital method is establishing stop-loss orders to restrict losses in situation the market relocates against an investor's position. By defining the optimal loss they are eager to bear in advance, investors can protect their funding from substantial declines.

Moreover, leveraging devices like hedging can further shield investors from adverse market movements. Ultimately, a disciplined and calculated technique to take the chance of monitoring is extremely important for lasting success in currency exchange trading.

Essential Vs. Technical Analysis

Some traders prefer fundamental analysis for its emphasis on macroeconomic variables that drive money worths, while others prefer technical analysis for its emphasis on price patterns and patterns. By integrating fundamental and technical analysis, investors can make even more enlightened decisions and improve their total trading efficiency - currency exchange in toronto.

Leveraging Trading Tools

With a solid structure in technological and fundamental analysis, money exchange investors can considerably improve their decision-making procedure by leveraging various trading tools. One crucial trading tool is the economic schedule, which aids traders track crucial financial events and statements that can impact money worths.

Psychology of Trading

Comprehending the psychological elements of trading is vital for money exchange traders to navigate the psychological challenges and prejudices that can affect their decision-making process. It is critical for traders to grow emotional self-control and keep a reasonable approach to trading.

One usual emotional trap that traders come under is confirmation prejudice, where they look for info that sustains their presumptions while neglecting inconsistent evidence. This can look at more info hinder their capability to adjust to transforming market conditions and make knowledgeable choices. Furthermore, the anxiety of missing out (FOMO) can drive investors to get in trades impulsively, without carrying out appropriate study or analysis.

Final Thought

Finally, mastering the art of currency exchange trading calls for a deep understanding of market trends, efficient danger administration approaches, knowledge of fundamental and technical analysis, utilization of trading tools, and awareness of the psychology of trading (currency exchange in toronto). By combining these elements, traders can make informed choices and increase their chances of success in the volatile globe of money trading

By peeling off back the layers of this detailed landscape, investors might reveal concealed understandings that might potentially transform their approach to currency exchange trading.

With a strong structure in technological and basic analysis, currency exchange traders can dramatically boost their decision-making procedure by leveraging different trading tools. One crucial trading device is the financial calendar, which helps traders track vital financial events and statements that might affect money worths. By leveraging these trading tools in combination with basic and technological evaluation, currency exchange investors can make smarter and a lot more calculated trading decisions in the vibrant foreign exchange market.

Comprehending the psychological facets of trading is necessary for currency exchange investors to browse the emotional obstacles and predispositions that can impact their decision-making procedure.

Report this page